Covid-19

Covid-19: Air Cargo – A Bright Spot in the Industry

February 2021

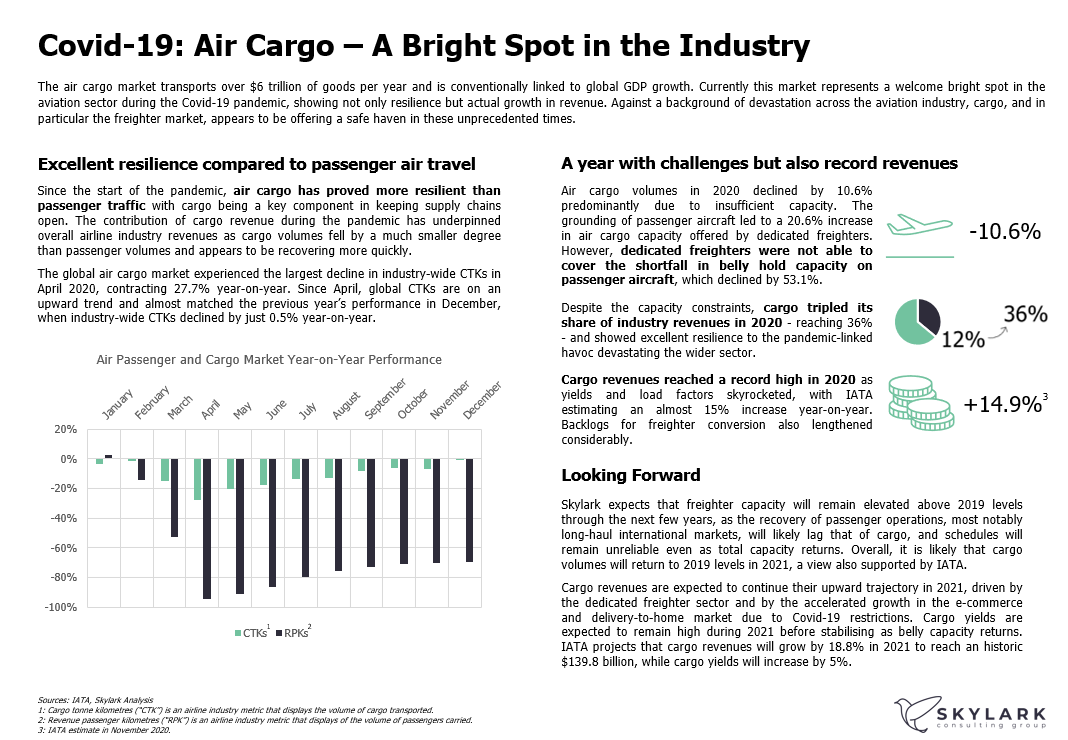

The air cargo market transports over $6 trillion of goods per year and is conventionally linked to global GDP growth. Currently this market represents a welcome bright spot in the aviation sector during the Covid-19 pandemic, showing not only resilience but actual growth in revenue.

Against a background of devastation across the aviation industry, cargo, and in particular the freighter market, appears to be offering a safe haven in these unprecedented times.

Covid-19: European Aviation Market Re-opening

September 2020

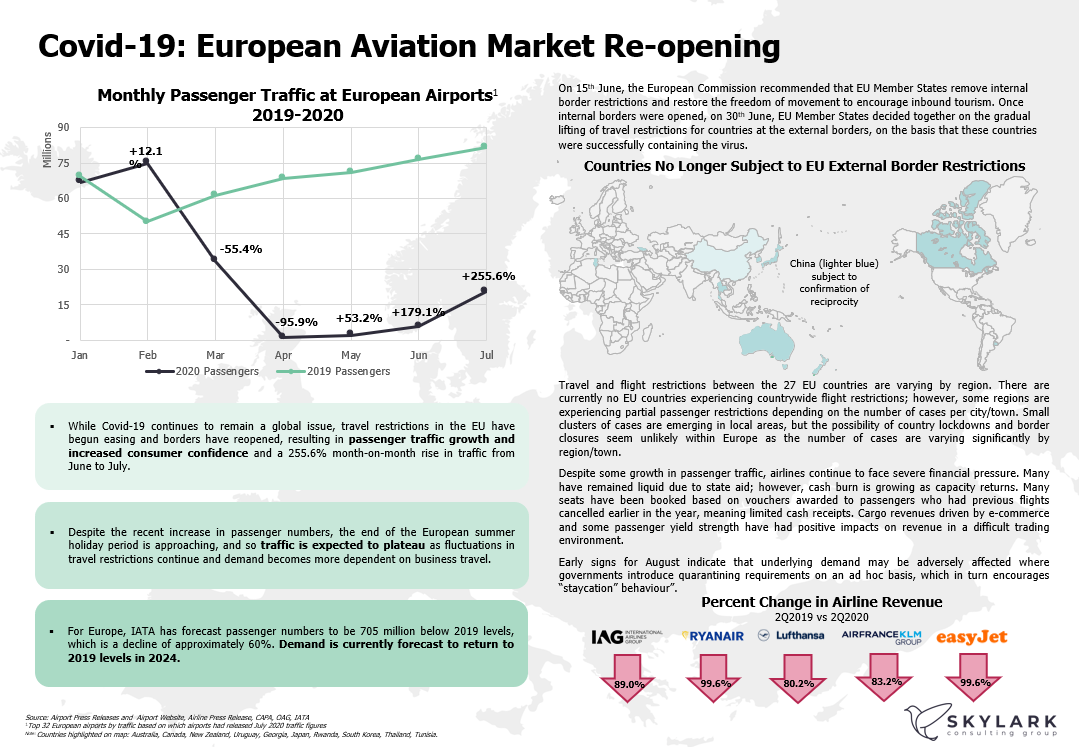

Travel restrictions in the EU have begun easing and borders have reopened, resulting in passenger traffic growth and increased consumer confidence and a 255.6% month-on-month rise in traffic from June to July.

Despite the recent increase in passenger numbers, the end of the European summer holiday period is approaching, and so traffic is expected to plateau as fluctuations in travel restrictions continue and demand becomes more dependent on business travel.

Covid-19: China’s Domestic Traffic Leads Asia-Pacific’s Recovery

September 2020

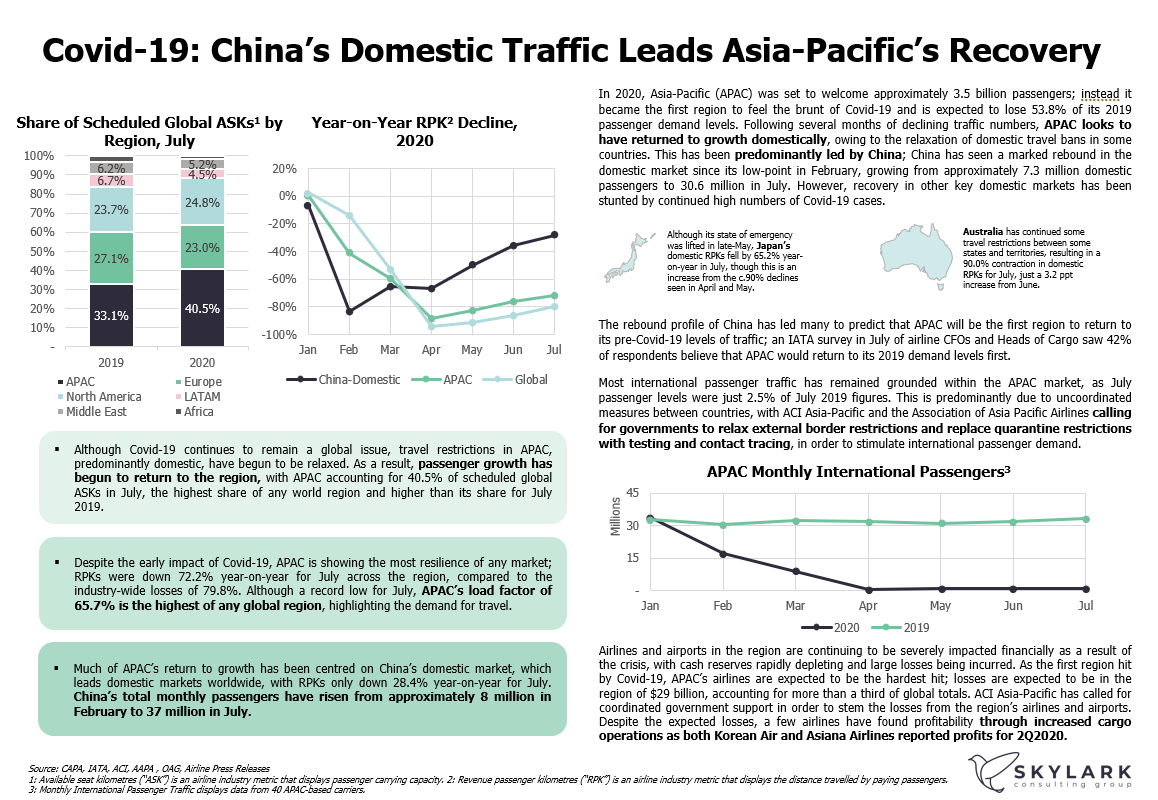

Although Covid-19 continues to remain a global issue, travel restrictions in APAC, predominantly domestic, have begun to be relaxed. As a result, passenger growth has begun to return to the region, with APAC accounting for 40.5% of scheduled global ASKs in July, the highest share of any world region and higher than its share for July 2019.

Covid-19: Scheduled Indian Domestic Traffic Resumes as Restrictions Are Lifted

June 2020

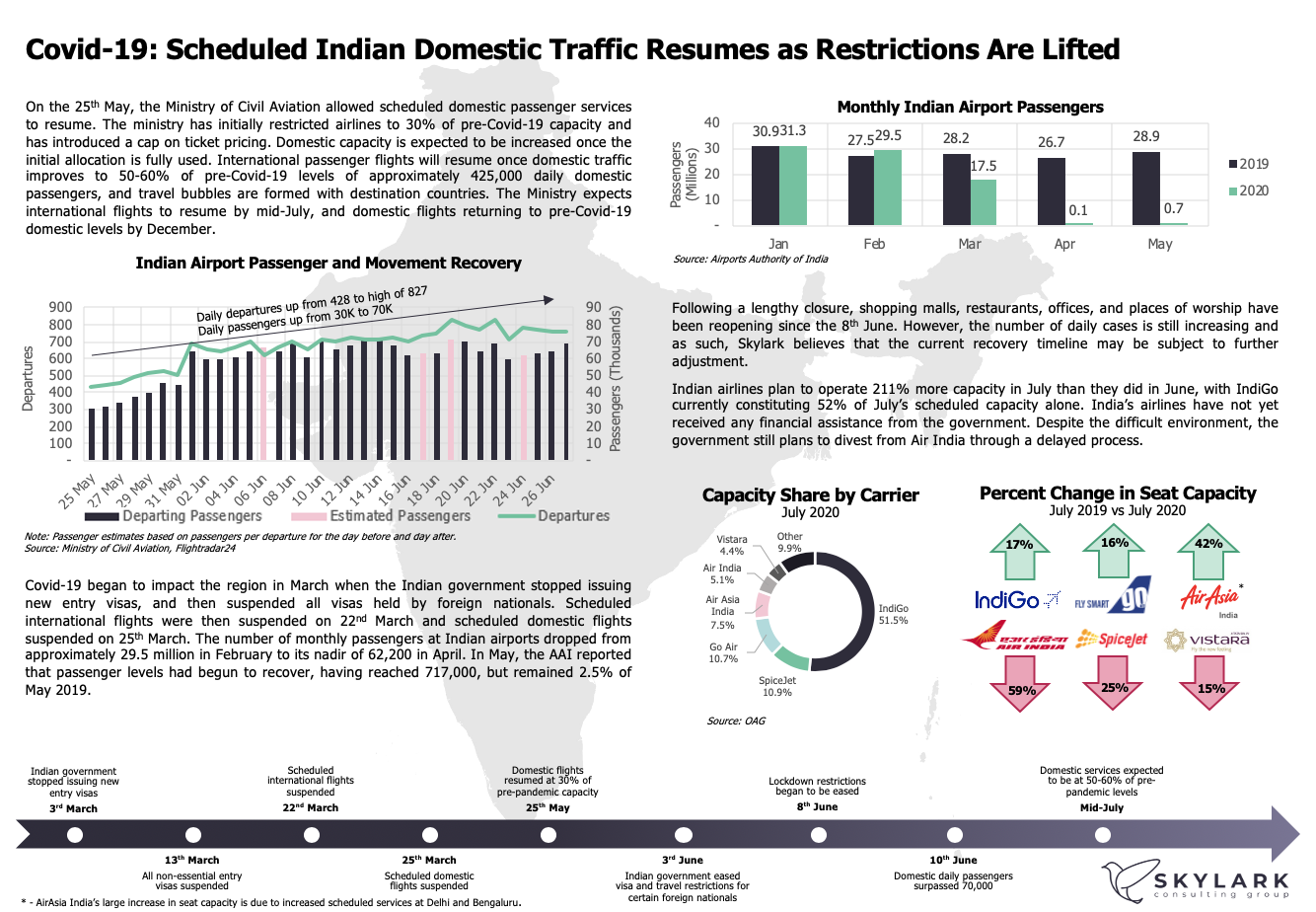

As Covid-19 began to impact India, the number of monthly passengers at Indian airports dropped from approximately 29.5 million in February to its low point of 62,000 in April.

Following the recent easing of travel restrictions, India has resumed scheduled domestic passenger services. Daily passenger numbers have now reached 70,000, and scheduled international services are expected to resume once this number reaches 50-60% of pre-pandemic levels.

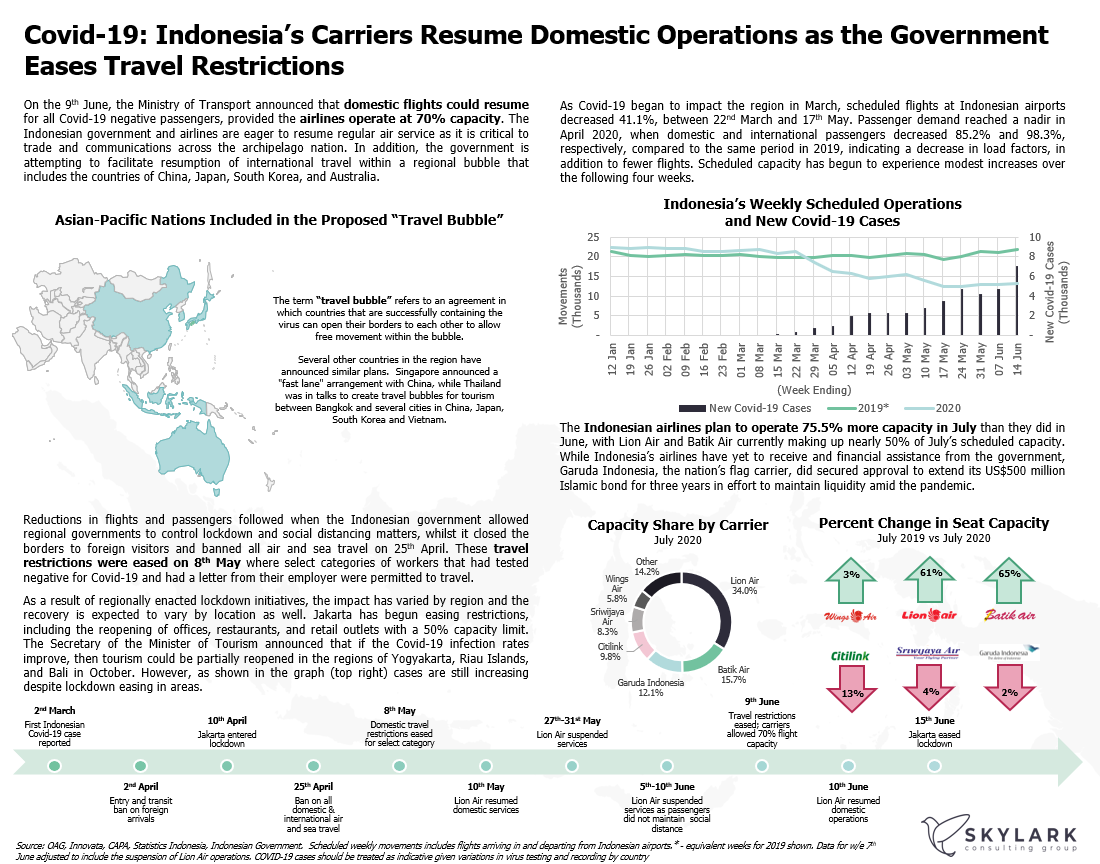

Covid-19: Indonesia’s Carriers Resume Domestic Operations as the Government Eases Travel Restrictions

June 2020

Skylark takes a look at the impact of Covid-19 on one of the world’s fastest growing air travel markets, Indonesia.

As Covid-19 began to impact the region in March, scheduled flights at Indonesian airports decreased 41.1% between 22nd March and 17th May. Scheduled capacity has begun to experience modest increases over the following four weeks.

Following the recent easing of travel restrictions, the Indonesian government and airlines are eager to resume regular air service as it is critical to trade and communications across the archipelago nation.

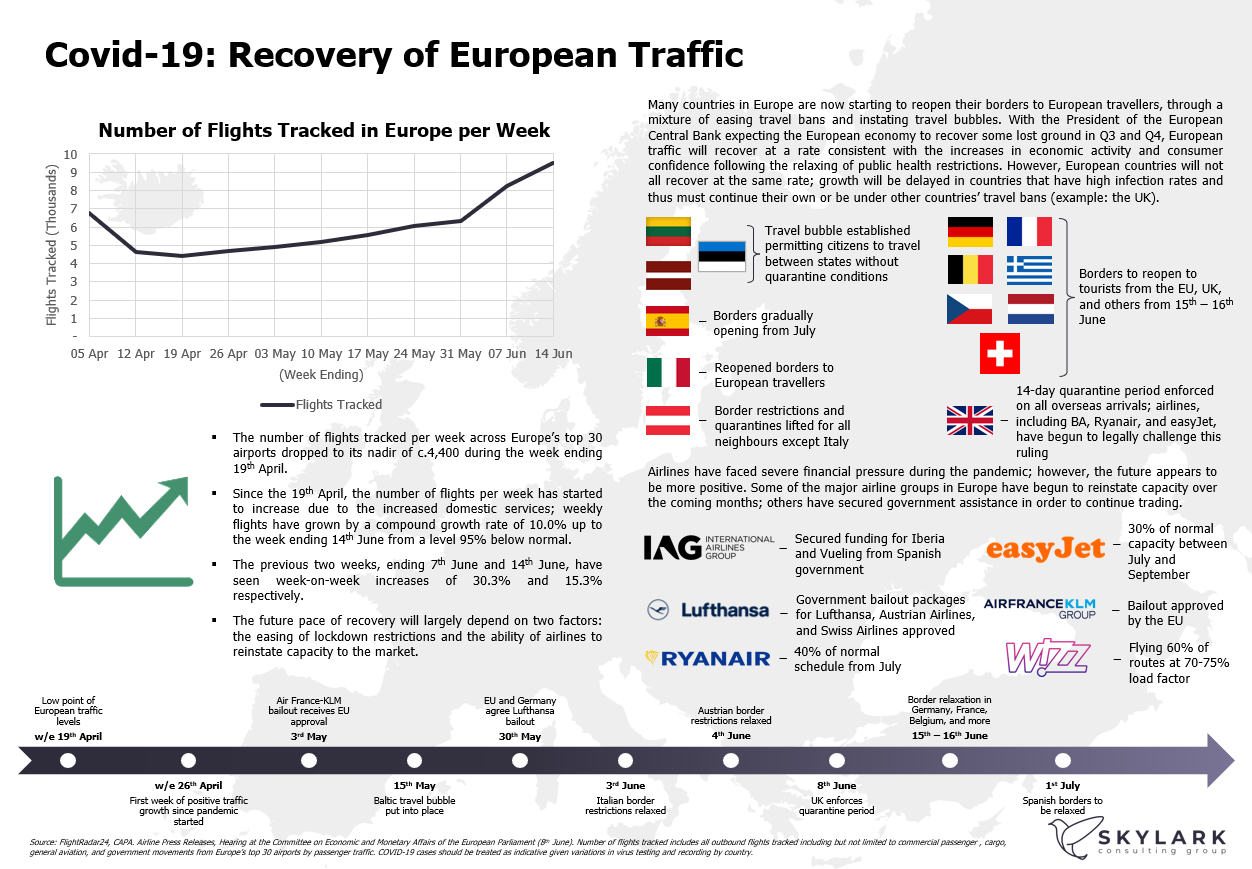

Covid-19: Recovery of European Traffic

June 2020

Many countries in Europe are now starting to reopen their borders to European travellers, through a mixture of easing travel bans and instating travel bubbles. The previous two weeks, ending 7th June and 14th June, flights per week across Europe’s top 30 airports have seen week-on-week increases of 30.3% and 15.3% respectively.

The future pace of recovery will largely depend on two factors: the easing of lockdown restrictions and the ability of airlines to reinstate capacity to the market.

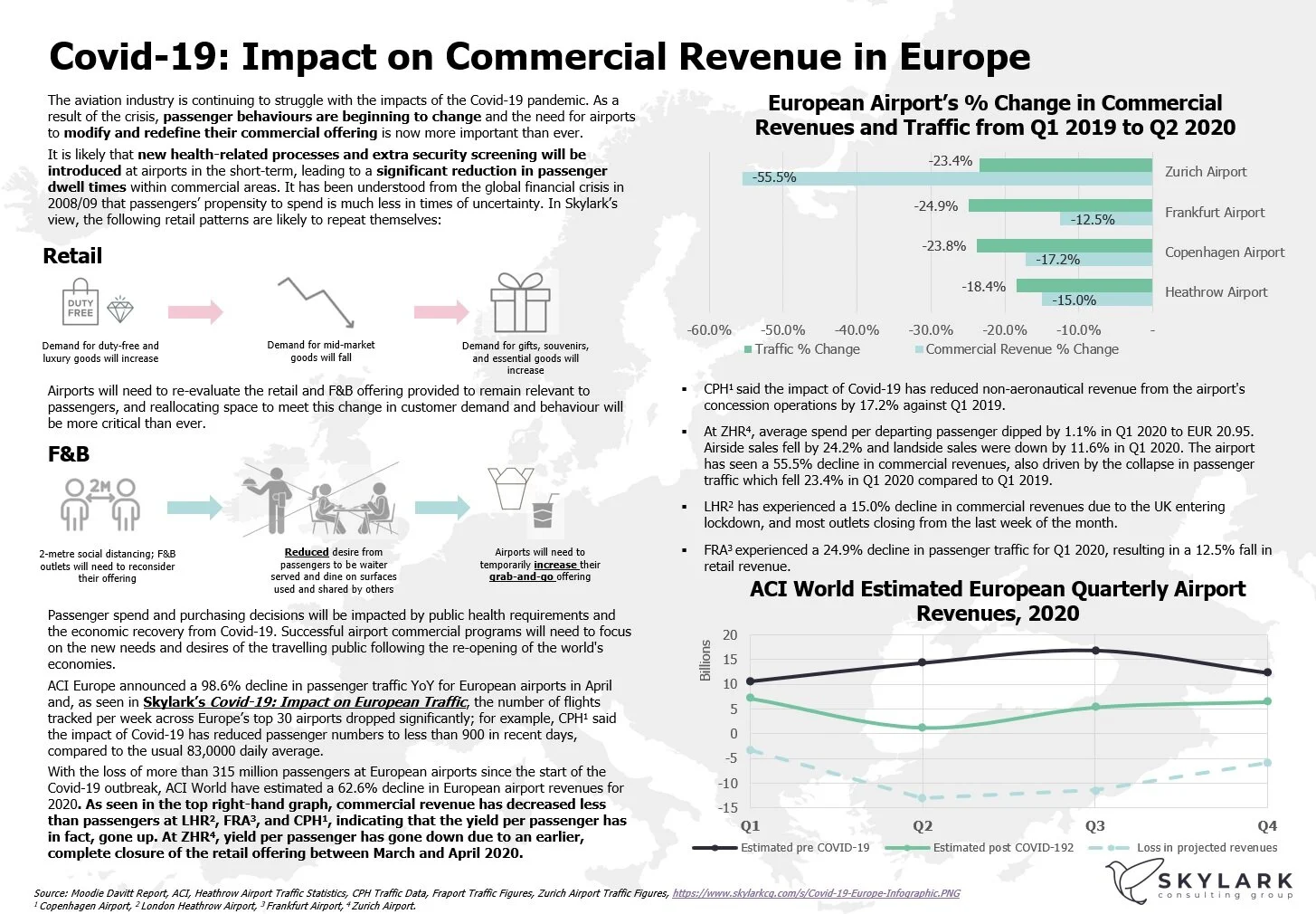

Covid-19: Impact on Commercial Revenue in Europe

June 2020

The aviation industry is continuing to struggle with the impacts of the Covid-19 pandemic. As a result of the crisis, passenger behaviours are beginning to change and the need for airports to modify and redefine their commercial offering is now more important than ever.

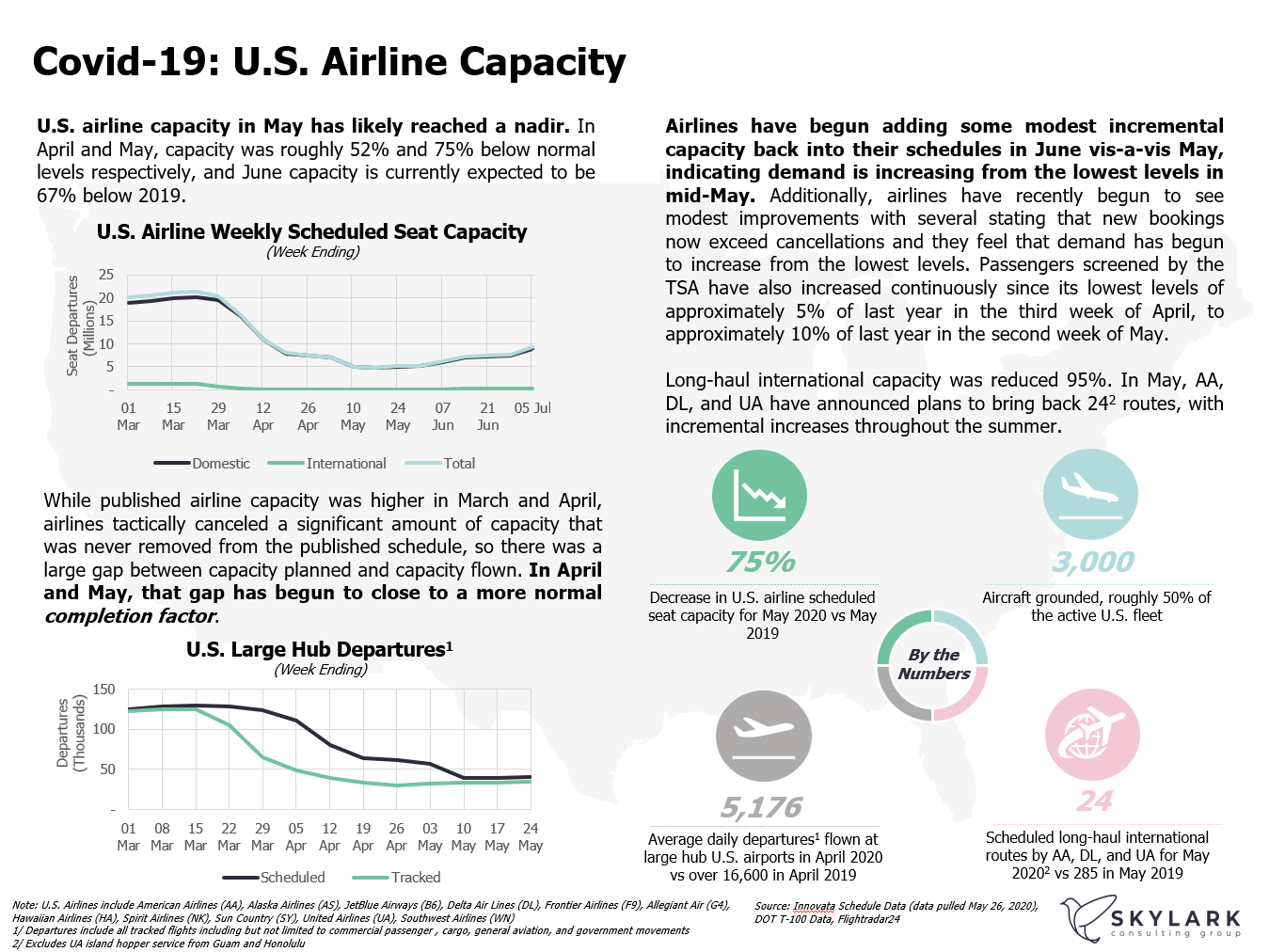

Covid-19: U.S. airline Capacity

May 2020

Skylark examines the decrease in U.S. airline capacity in April and May, and the nascent capacity increases in June.

Domestic capacity increases have been trending higher for the last few weeks; while international capacity is returning much more slowly.

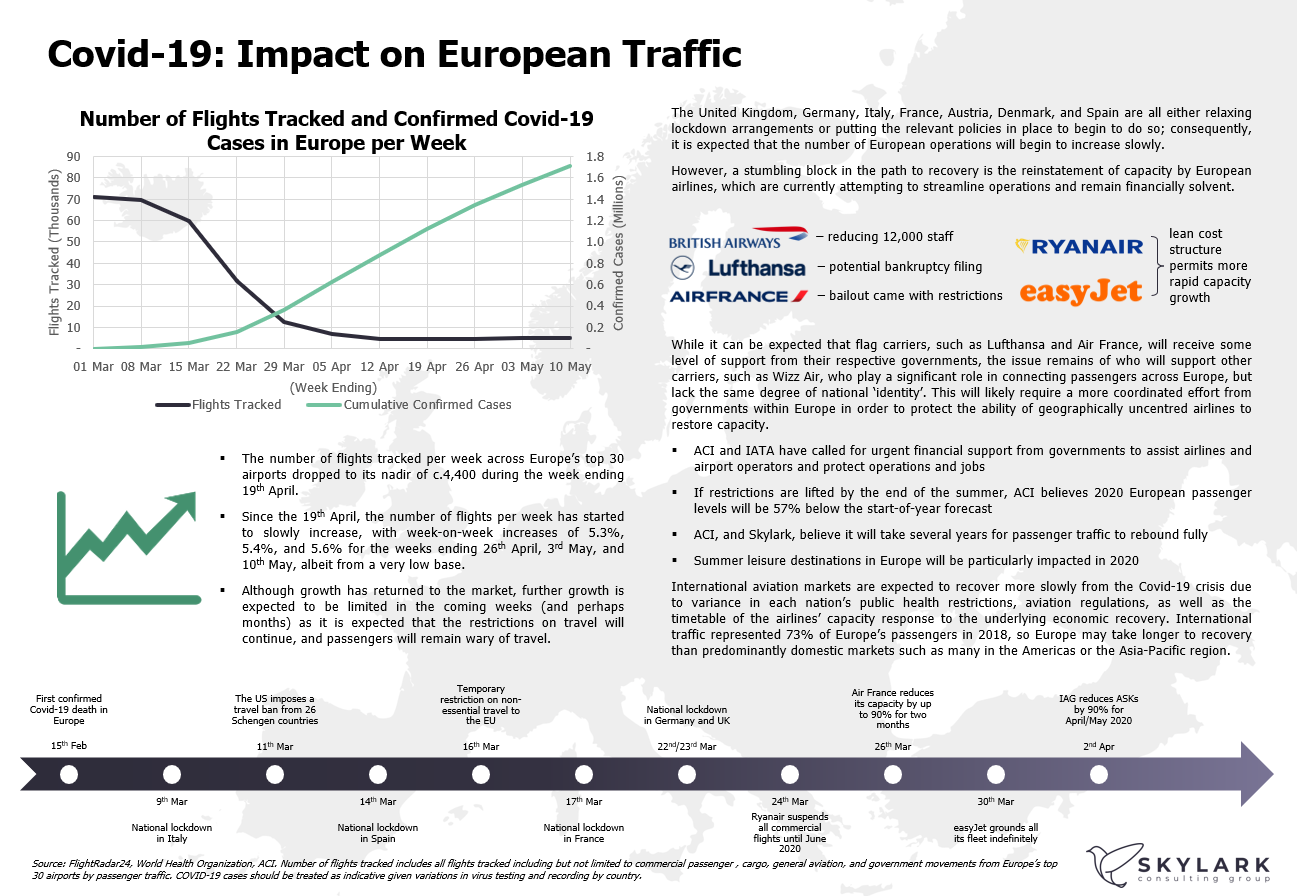

Covid-19: Impact on European Traffic

May 2020

The number of flights tracked per week across Europe’s top 30 airports dropped to its nadir during the week ending 19th April. Since then flights per week have started to slowly increase.

Although growth has returned to the market, further growth is expected to be limited in the coming weeks (and perhaps months) as it is expected that the restrictions on travel will continue, and passengers will remain wary of travel.

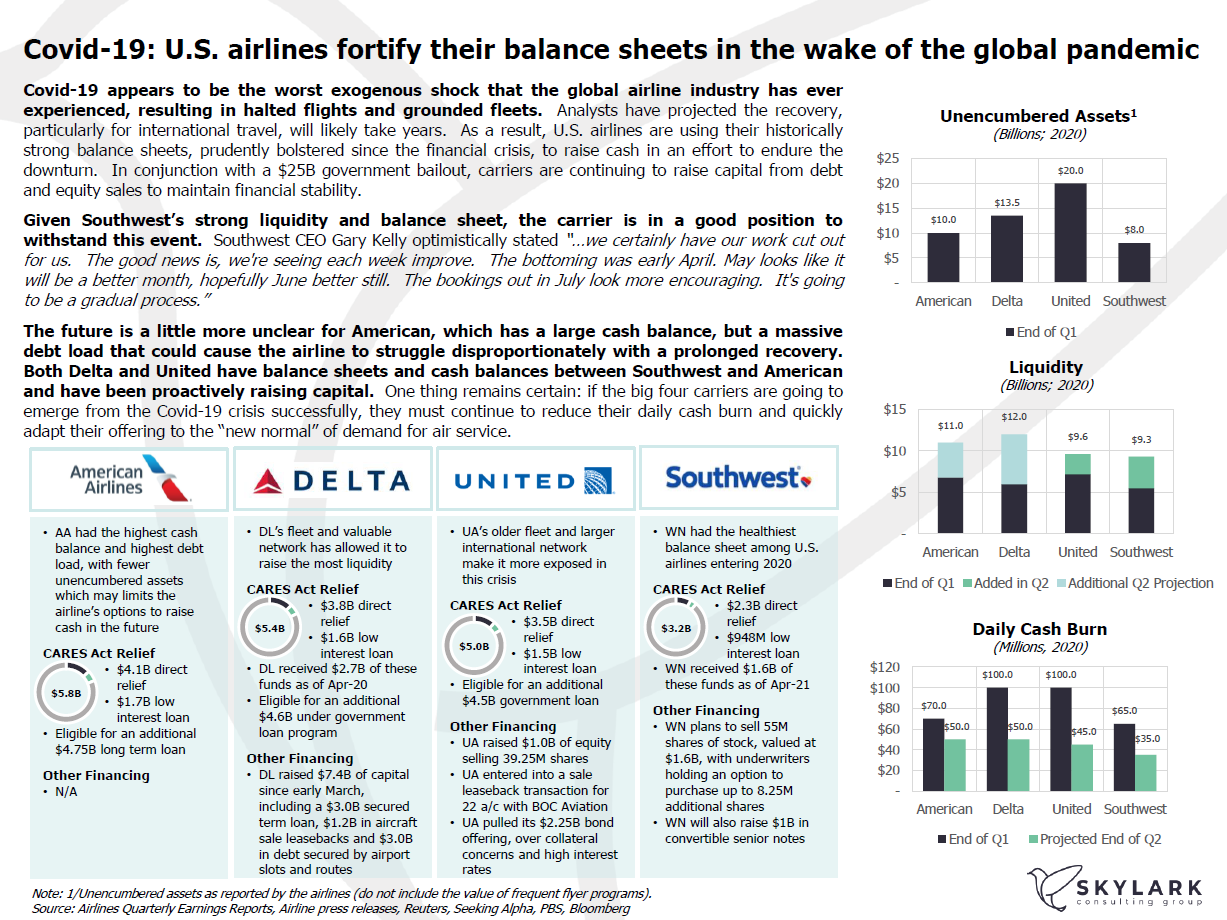

Covid-19: U.S. airlines fortify their balance sheets in the wake of the global pandemic

May 2020

With the global airline industry in a holding pattern as result of the Covid-19 pandemic, U.S. airlines have been strengthening their balance sheets to withstand the downturn and long recovery projected by analysts.

Along with raising capital from debt and equity sales, carriers have received a portion of a $25 billion bailout program from the U.S. government to help cover costs while fleets remain grounded.

This document has been updated to reflect United’s cancelling of its $2.25 billion debt offering on Friday 8th May 2020, due to concerns over the airline’s collateral as well as high interest rates. Other updates include Delta’s additional capital raise backed by airport slots and routes .

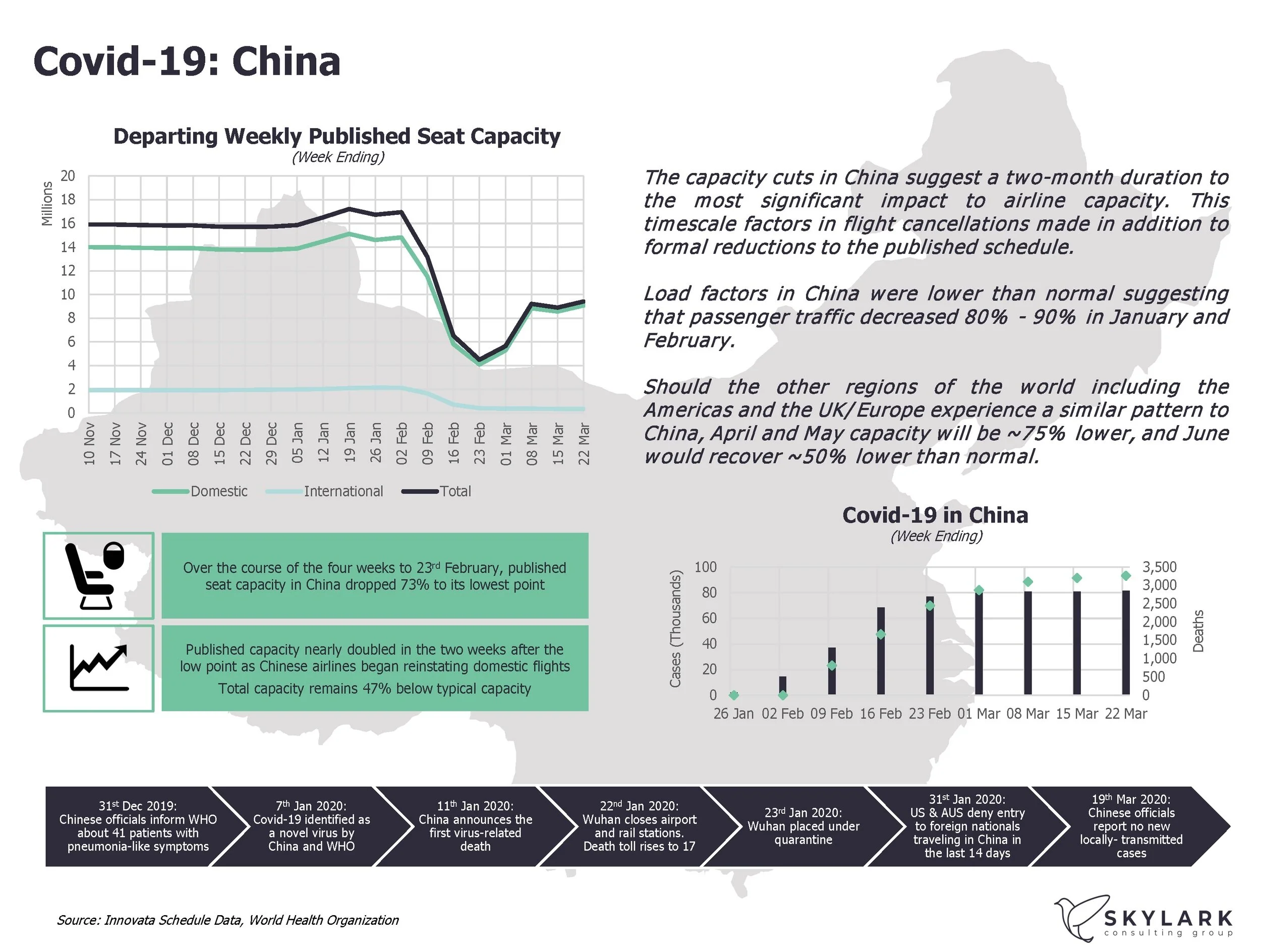

Covid-19: China

April 2020

The Covid-19 pandemic has driven material reductions in seat capacity in China. The profile of capacity reductions in China suggests a two-month duration to the most significant impacts.

Should the other regions of the world including the Americas and the UK/Europe experience a similar pattern to China, April and May capacity will be ~75% lower, and June would recover ~50% lower than normal.

Skylark Statement on Covid-19

April 2020

At Skylark, we hold dear the safety of our clients, partners, and colleagues. While we are unable to come together physically, we will continue to work remotely in accordance with the guidelines provided by the authorities. We will continue to offer our full service proposition, and will provide additional support to any client who may require it in these difficult times. Our expert team is working hard to find new ways to share relevant thoughts and insights on both the current crisis and on broader issues.

We appreciate this is an extremely challenging period, particularly for the aviation industry. We also believe that people and businesses will be stronger if they come together, and work as one to navigate the challenges ahead. If we can help, or if you would like to discuss any issue, then please contact us on contact@skylarkcg.com.

Best wishes,

The Skylark Team